- ‘Choi Jin-sil’s daughter’ Choi Jun-hee reveals before and after diet from 96 kg to 49 kg… Dramatically changed visuals‘Choi Jin-sil’s daughter’ Choi Jun-hee reveals before and after diet …

- A Powerful Figure in the Vatican who was considered the ‘next Pope’ sentenced to prison for real estate corruption

A powerful figure in the Vatican who was considered the …

A powerful figure in the Vatican who was considered the … - 3 Things to Watch Out for in the Development of ‘Young Colon Cancer’

Excessive Drinking, Obesity, Lack of Exercise… 3 Things to Watch …

Excessive Drinking, Obesity, Lack of Exercise… 3 Things to Watch …3 Things to Watch Out for in the Development of ‘Young Colon Cancer’ Read More »

- ‘Nicholson-Bélangel 49-point Collaboration’ Korea Gas Corporation Puts a Brake on LG’s 7-Game Winning Streak

‘Nicholson-Bélangel 49-point Collaboration’ Korea Gas Corporation Puts a Brake on …

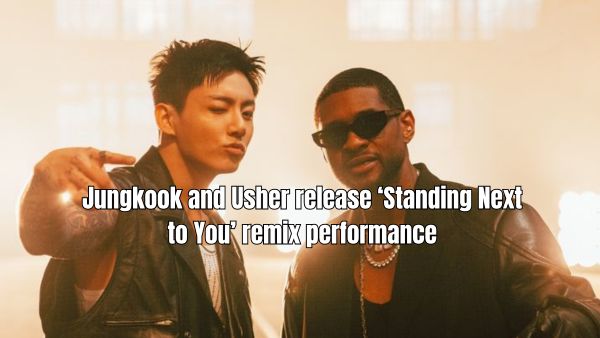

‘Nicholson-Bélangel 49-point Collaboration’ Korea Gas Corporation Puts a Brake on … - Jungkook and Usher Release ‘Standing Next to You’ Remix Performance

Jungkook and Usher Release ‘Standing Next to You’ Remix Performance …

Jungkook and Usher Release ‘Standing Next to You’ Remix Performance …Jungkook and Usher Release ‘Standing Next to You’ Remix Performance Read More »

- A Dream that Began 70 years ago with ‘Nuclear-Powered Aircraft’… Safe ‘Liquid Salt’ Reactor

A Dream that Began 70 years ago with ‘Nuclear-Powered Aircraft’… …

A Dream that Began 70 years ago with ‘Nuclear-Powered Aircraft’… … - Will Ukraine Survive without Support from the U.S.? “We May Lose Next Summer” CNN

Will Ukraine Survive without Support from the U.S.? “We May …

Will Ukraine Survive without Support from the U.S.? “We May …Will Ukraine Survive without Support from the U.S.? “We May Lose Next Summer” CNN Read More »

- Hormone that causes morning sickness during pregnancy discovered

Hormone that causes morning sickness during pregnancy discovered The cause …

Hormone that causes morning sickness during pregnancy discovered The cause …Hormone that causes morning sickness during pregnancy discovered Read More »

- Coach Spalletti is nominated for FIFA Coach of the Year Award

Coach Spalletti is nominated for FIFA Coach of the Year …

Coach Spalletti is nominated for FIFA Coach of the Year …Coach Spalletti is nominated for FIFA Coach of the Year Award Read More »

- 49-year-old DiCaprio is rumored to be dating a 25-year-old woman

49-year-old DiCaprio is rumored to be dating a 25-year-old woman… …

49-year-old DiCaprio is rumored to be dating a 25-year-old woman… …49-year-old DiCaprio is rumored to be dating a 25-year-old woman Read More »

- Powell’s ‘interest rate pivot’… Three cuts Expected Next Year

Powell’s ‘interest rate pivot’… Three cuts Expected Next Year The …

Powell’s ‘interest rate pivot’… Three cuts Expected Next Year The …Powell’s ‘interest rate pivot’… Three cuts Expected Next Year Read More »

- Trump denied ‘tolerating North Korea’s Nuclear Weapons’

Trump denied ‘tolerating North Korea’s Nuclear Weapons’… Possibility of negotiations …

Trump denied ‘tolerating North Korea’s Nuclear Weapons’… Possibility of negotiations …Trump denied ‘tolerating North Korea’s Nuclear Weapons’ Read More »

- US Fed hints at three interest rate cuts… Dow exceeds 37,000 for the first time in history

US Fed hints at three interest rate cuts… Dow exceeds 37,000 …

US Fed hints at three interest rate cuts… Dow exceeds 37,000 … - Which President Watched 10 movies a Month while in Office?

Which President Watched 10 movies a Month while in Office? …

Which President Watched 10 movies a Month while in Office? …Which President Watched 10 movies a Month while in Office? Read More »

- Oprah Winfrey loses 40kg… Diet secret revealed

Oprah Winfrey loses 40kg… Diet secret revealed Oprah Winfrey, the …

Oprah Winfrey loses 40kg… Diet secret revealed Oprah Winfrey, the … - 700 million dollars’ ransom for Otani… More than 12 years worth of salary for KBO Players

700 million dollars’ ransom for Otani… More than 12 years …

700 million dollars’ ransom for Otani… More than 12 years … - Shin Joo-ah, -“Even if I’m born again, I’m still my father’s daughter”

Actress Shin Joo-ah (39, Ji-hye Kim) expressed her longing for …

Actress Shin Joo-ah (39, Ji-hye Kim) expressed her longing for …Shin Joo-ah, -“Even if I’m born again, I’m still my father’s daughter” Read More »

- Watching a movie is also subject to a 30% income tax deduction

‘Watching a movie’ is also subject to a 30% income …

‘Watching a movie’ is also subject to a 30% income …Watching a movie is also subject to a 30% income tax deduction Read More »

- US urges China to stop dangerous actions following conflict with the Philippines in South China

US urges China to stop dangerous actions following conflict with …

US urges China to stop dangerous actions following conflict with … - [Yang Jong-gu’s health method for the age of 100] “Thanks to Nordic walking

![[Yang Jong-gu's health method for the age of 100] “Thanks to Nordic walking](https://theattitudequotes.com/wp-content/uploads/2023/12/Yang-Jong-gus-health-method-for-the-age-of-100-Thanks-to-Nordic-walking.jpg) [Yang Jong-gu’s health method for the age of 100] “Thanks …

[Yang Jong-gu’s health method for the age of 100] “Thanks …[Yang Jong-gu’s health method for the age of 100] “Thanks to Nordic walking Read More »

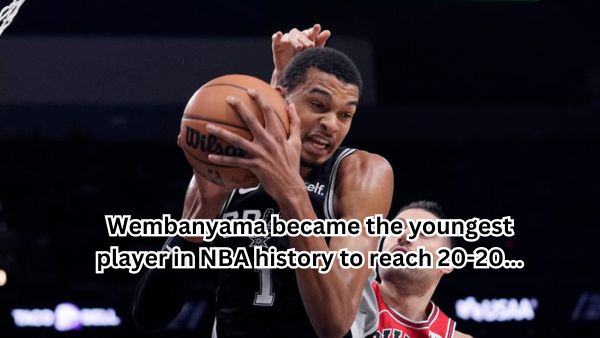

- Wembanyama became the youngest player in NBA history to reach 20-20…

Wembanyama became the youngest player in NBA history to reach …

Wembanyama became the youngest player in NBA history to reach …Wembanyama became the youngest player in NBA history to reach 20-20… Read More »

- ‘Newlywed’ Daniel Henney hugs and sweetly kisses Lou Kumagai

‘Newlywed’ Daniel Henney hugs and sweetly kisses Lou Kumagai Actors …

‘Newlywed’ Daniel Henney hugs and sweetly kisses Lou Kumagai Actors …‘Newlywed’ Daniel Henney hugs and sweetly kisses Lou Kumagai Read More »

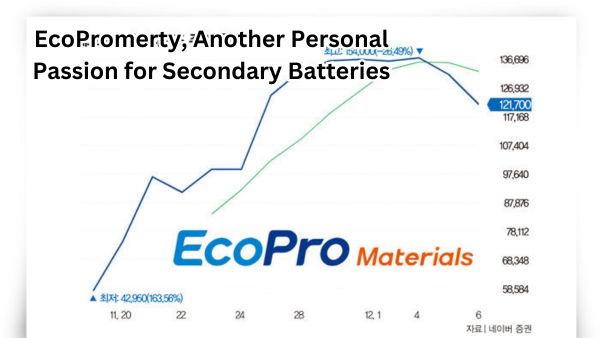

- EcoPromerty, Another Personal Passion for Secondary Batteries

EcoPromerty, Another Personal Passion for Secondary Batteries “KOSPI 200 special …

EcoPromerty, Another Personal Passion for Secondary Batteries “KOSPI 200 special …EcoPromerty, Another Personal Passion for Secondary Batteries Read More »

- The ROK-US alliance has expanded to include technology in addition to the military and economy.

The ROK-US alliance has expanded to include technology in addition …

The ROK-US alliance has expanded to include technology in addition … - Lee Jung-jae and Jung Woo-sung gave 12 billion won to a big data company…

Lee Jung-jae and Jung Woo-sung gave 12 billion won to …

Lee Jung-jae and Jung Woo-sung gave 12 billion won to …Lee Jung-jae and Jung Woo-sung gave 12 billion won to a big data company… Read More »

- PGA is shocked… ‘King of Multiple Wins’ Ram transfers to LIV after receiving 785 Billion won in Down Payment

PGA is shocked… ‘King of Multiple Wins’ Ram transfers to LIV …

PGA is shocked… ‘King of Multiple Wins’ Ram transfers to LIV … - “LOL May the deceased rest in peace”… Byeok-ga, a malicious comment that made my mother cry while fighting a brain tumor

“LOL May the deceased rest in peace”… Byeok-ga, a malicious comment …

“LOL May the deceased rest in peace”… Byeok-ga, a malicious comment … - ‘Redback’, an armored vehicle that jumped in without a blueprint, was exported to Australia for KRW 3 trillion

‘Redback’, an armored vehicle that jumped in without a blueprint, …

‘Redback’, an armored vehicle that jumped in without a blueprint, … - Biden: “Republicans are trying to give a gift to Putin… “After Ukraine, NATO and the U.S.”

Biden: “Republicans are trying to give a gift to Putin… “After …

Biden: “Republicans are trying to give a gift to Putin… “After … - Which part of the body’s aging clock is faster? You can look into it with a blood test

Which part of the body’s aging clock is faster? You can …

Which part of the body’s aging clock is faster? You can …Which part of the body’s aging clock is faster? You can look into it with a blood test Read More »

- “Golf balls fly far away, reducing detail wins” “If long shots decrease, box office hits”

“Golf balls fly far away, reducing detail wins” “If long …

“Golf balls fly far away, reducing detail wins” “If long … - Netflix’s most successful series ‘Squid Game’, was revealed for the first time.

Netflix’s most successful series ‘Squid Game’, was revealed for the …

Netflix’s most successful series ‘Squid Game’, was revealed for the …Netflix’s most successful series ‘Squid Game’, was revealed for the first time. Read More »

- 89% of EU: “We will collect windfall tax”… Review of upper line pasta price cap

89% of EU: “We will collect windfall tax”… Review of upper …

89% of EU: “We will collect windfall tax”… Review of upper …89% of EU: “We will collect windfall tax”… Review of upper line pasta price cap Read More »

- Putin visits Bin Salman and says, “We can’t stop friendship”… Counterattacking the U.S. pressure to isolate

Putin visits Bin Salman and says, “We can’t stop friendship”… …

Putin visits Bin Salman and says, “We can’t stop friendship”… … - US YouTuber sentenced to 6 months in prison for intentionally crashing plane

An American YouTuber who competed in the Olympics as a …

An American YouTuber who competed in the Olympics as a …US YouTuber sentenced to 6 months in prison for intentionally crashing plane Read More »

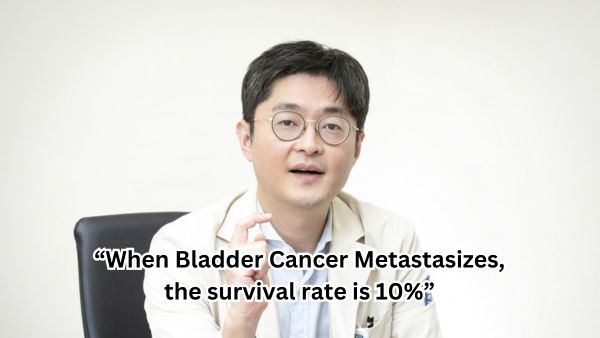

- “When Bladder Cancer Metastasizes, the survival rate is 10%”

“When bladder cancer metastasizes, the survival rate is 10%… “Immunotherapy drugs …

“When bladder cancer metastasizes, the survival rate is 10%… “Immunotherapy drugs …“When Bladder Cancer Metastasizes, the survival rate is 10%” Read More »

- When Chan-sung Jung leaves, Jeong-young Lee comes… UFC debut in February Next Year

When Chan-sung Jung leaves, Jeong-young Lee comes… UFC debut in February …

When Chan-sung Jung leaves, Jeong-young Lee comes… UFC debut in February …When Chan-sung Jung leaves, Jeong-young Lee comes… UFC debut in February Next Year Read More »

- Blackpink renews contract with YG for ‘Group Activities’

Blackpink renews contract with YG for ‘Group Activities’ K-pop’s signature …

Blackpink renews contract with YG for ‘Group Activities’ K-pop’s signature …Blackpink renews contract with YG for ‘Group Activities’ Read More »

- Extinction of a nation due to low birth rate? What Sparta and the Roman Empire Teach Us

Extinction of a nation due to low birth rate? What Sparta …

Extinction of a nation due to low birth rate? What Sparta …Extinction of a nation due to low birth rate? What Sparta and the Roman Empire Teach Us Read More »

- Cho Hee-dae, As soon as I take office, I will consider introducing a ‘Conditional Arrest Warrant system’

Cho Hee-dae, As soon as I take office, I will …

Cho Hee-dae, As soon as I take office, I will …